8 Steps to Filling Out the FAFSA Form

Need to fill out the Free Application for Federal Student Aid (FAFSA) form but don’t know where to start? I’m here to help. Let’s walk through the process step by step.

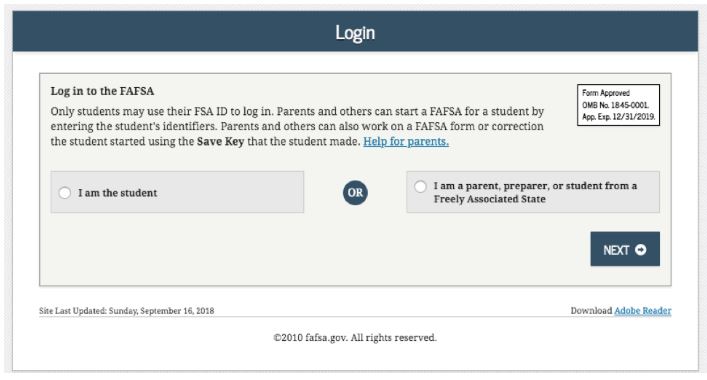

1. Create an account (FSA ID).

- Student: An FSA ID is a username and password you need to sign the FAFSA form online. If you don’t have an FSA ID, get an FSA ID here. It takes about 10 minutes to create an FSA ID. If this will be your first time filling out the FAFSA form, you’ll be able to use your FSA ID to sign and submit your FAFSA form online. If this is not your first time filling out the FAFSA form, you may need to wait one to three days for the account verification process before you can use your new FSA ID to renew your FAFSA form and sign it online.

- Parent: If your child is required to report parent information on the FAFSA form, you need to create your own FSA ID in order to sign your child’s FAFSA form online. Parents are able to use their FSA IDs right away.

IMPORTANT: Some of the most common FAFSA errors occur when the student and parent mix up their FSA IDs. If you don’t want your financial aid to be delayed, it’s extremely important that each parent and each student create his or her own FSA ID and that they do not share it with ANYONE, even each other.

2. Start the FAFSA form at fafsa.gov.

You will fill out the FAFSA form for the student’s school year of college. For current seniors (class of 2021) who will start college in Fall 2021, that will be the 2021-22 FAFSA.

The 2021–22 FAFSA form is available on October 1, 2020.

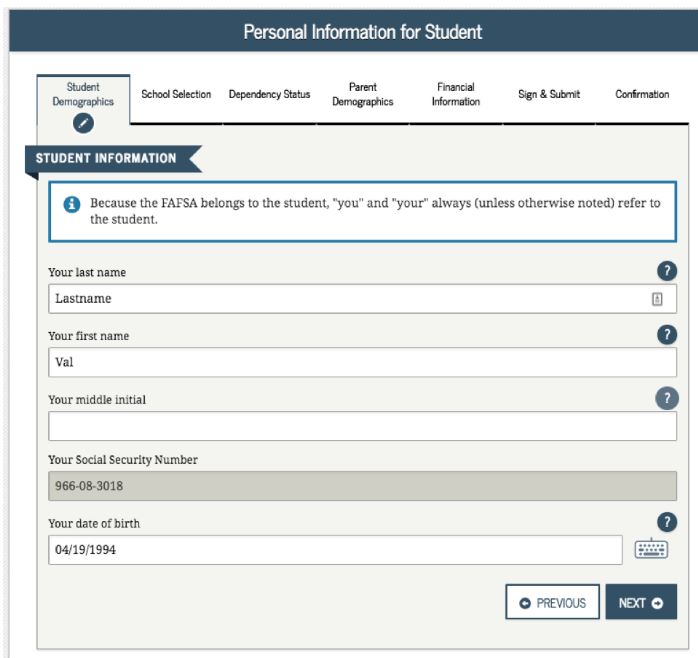

3. Fill out the Student Demographics section.

This is information such as your name, date of birth, etc. If you have completed the FAFSA form in the past or if you log into the FAFSA form with your FSA ID, a lot of your personal information will be prepopulated to save you time. Make sure you enter your personal information exactly as it appears on your Social Security card. (That’s right, no nicknames.)

Parents: Remember that the FAFSA form is the student’s application, not yours. When the FAFSA form says “you” or “your,” it’s referring to the student. Pay attention to whether you’re being asked for student or parent information. When in doubt, the banner on the left side will indicate whether you’re on a student or parent page.

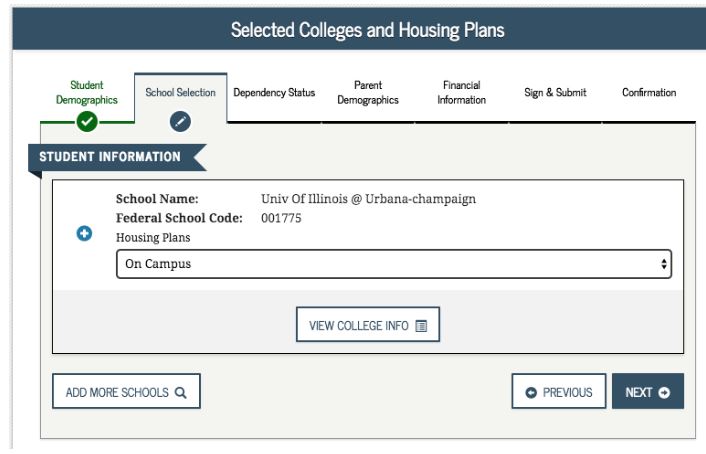

4. List the schools to which you want your FAFSA® information sent.

In the School Selection section, add every school you’re considering, even if you haven’t applied or been accepted yet. It doesn’t hurt your application to add more schools; colleges can’t see the other schools you’ve added. In fact, you don’t even have to remove schools if you later decide not to apply or attend. If you don’t end up applying or getting accepted to a school, the school can just disregard your FAFSA form.

But, you can remove schools at any time to make room for new schools. You can add up to 10 schools at a time. If you’re applying to more than 10 schools, here’s what you should do.

5. Answer the dependency status questions.

In the dependency status section, you’ll be asked a series of specific questions to determine whether you are required to provide parent information on the FAFSA form.

The dependency guidelines are set by Congress and are different from those used by the Internal Revenue Service (IRS). Even if you live on your own, support yourself, and file taxes on your own, you may still be considered a dependent student for federal student aid purposes. If you are determined to be a dependent student, you’ll be required to report information about your parent(s). If you’re determined to be an independent student, you won’t have to provide parent information and you can skip the next step.

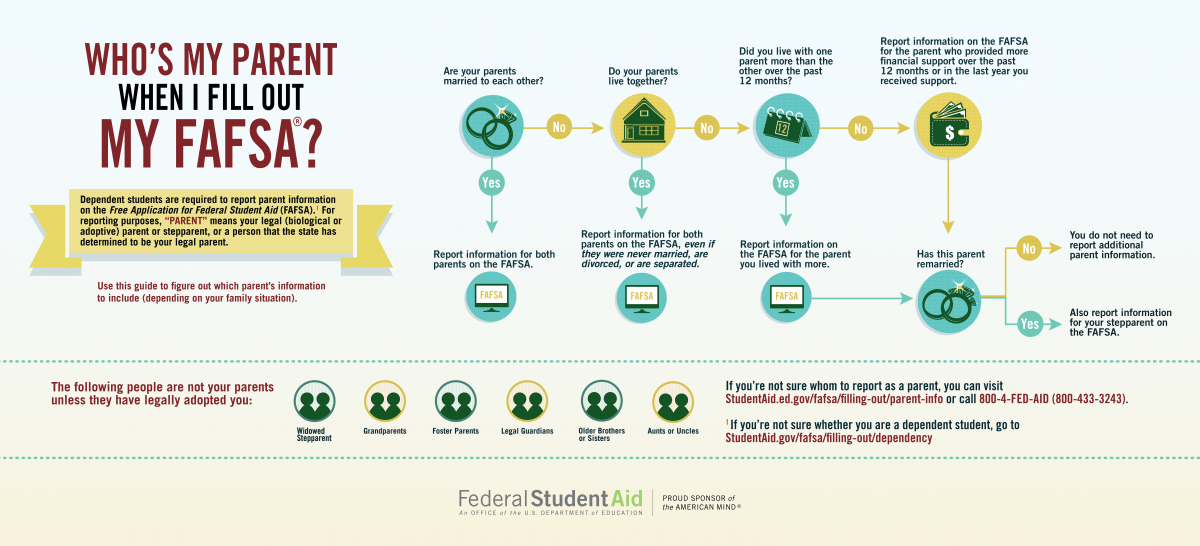

6. Fill out the Parent Demographics section.

This is where your parent(s) will provide basic demographic information. Remember that it doesn’t matter if you don’t live with your parent(s); you still must report information about them if you were determined to be a dependent student in the step above.

Start by figuring out who counts as your parent on the FAFSA form.

7. Supply your financial information.

Here is where you and your parent(s) will provide your financial information. For the 2021-2022 FAFSA season, you will need 2019 tax returns! Let me repeat – you will need 2019 tax returns if you are filling out the FAFSA starting October 1, 2020, for the 2021-2022 school year.

You will be guided through parents’ tax filing status and parent assets before entering information about the student’s income. For parents’ assets, do not include the value of your primary residence.

Other financial information is NOT needed:

- Retirement accounts (IRAs, Roth IRAs, 401k, 403b, etc)

- Cash value life insurance

- Equity in your primary home

This step is incredibly simple if you use the IRS Data Retrieval Tool (DRT), which allows you to import your IRS tax information into the FAFSA form with just a few clicks. Using this tool also may reduce the amount of paperwork you need to provide to your school. So if you’re eligible, use it! To access the tool, indicate that you’ve “already completed” taxes on the student or parent finances page. If you’re eligible, you’ll see a “LINK TO IRS” button. Choose that option and follow the prompts.

Questions about specific lines? Here’s a step-by-step guide to each FAFSA question.

8. Sign and submit your FAFSA form.

You’re not finished with the FAFSA form until you (and your parent, if you’re a dependent student) sign it. The quickest and easiest way to sign your FAFSA form is online with your FSA ID.

Finally, you will go ahead an electronically sign the FAFSA. You will receive a confirmation from the site that you are done.

Your LAST STEP is to have your student sign in to the FAFSA site using their FSA ID and Sign & Submit the FAFSA form themselves.

Helpful Links

FSA ID Website: https://fsaid.ed.gov/npas/index.htm

Federal Student Aid Resources: https://studentaid.ed.gov/sa/resources

FAFSA Site: https://fafsa.ed.gov/

FAFSA Help Line: 1-800-4Fed-AID (1-800-433-3243)

I’m finished. What’s next?

Congrats on finishing! You’re one step closer to getting money for college.